Stocks Surge. Human Capital to Crash?

For decades, the retirement of Baby Boomers has been discussed as a LOOMING ECONOMIC THREAT. The recent recession delayed the inevitable as billions in retirement savings vanished and forced many to stay in the workforce longer than anticipated. In a recent survey, the Transamerica Center for Retirement Studies (TCRS) found that retirement confidence has been recovering in step with the slow economic recovery over the past few years. In late 2016, 62% of Baby Boomers reported being confident that they will be able to fully retire with a comfortable lifestyle, which was up significantly from just 49% in their 2012 survey.

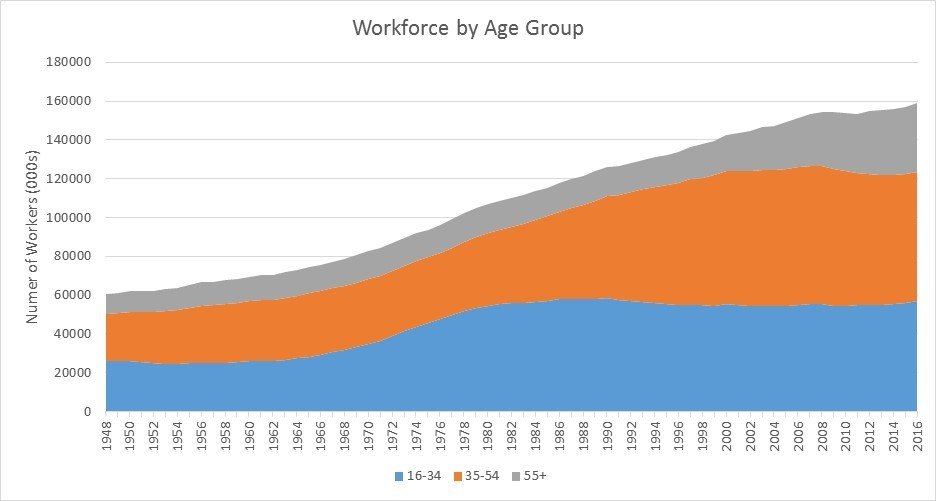

In the last few months, the Dow Jones Industrial Average has surged up from 18,000 and has been holding steady near 20,000. What impact will this dramatic post-electoral surge, if sustained at any level, have on retirement rates? Over 10,000 American workers are hitting the average retirement age of 65 every day and 9 MILLION are already past retirement age; many having postponed their retirement due to financial instability. US companies are inevitably facing retirement rates nearly twice as high as ever before. The question is WHEN, not IF companies will be forced to swallow this retirement backlog like a mouse moving through a snake. A chart of workforce makeup by age group illustrates the coming wave. In 1980, all Boomers were in the 16-34 age group; in 2000, they fell into the 36-54 group. By 2019, the Boomers will all be 55 and older with over half having already passed the Social Security retirement age of 65.

The group of workforce participants now approaching or past retirement age, mostly Boomers, have been the lynchpin of organizational vitality since the ‘70s. They have already left an indelible mark on the US economy and have set leadership and cultural standards for US businesses. However, it may be how the mass exodus of this celebrated generation is orchestrated that will cement their legacy. Who will FILL THE VOID? And HOW?

Measured by unemployment rates alone the recession’s impact on the labor market was equal to the recession in the early ‘80s, but the influence it will have on organizations moving forward will be much more impactful. The participation rate of workers 16-54 has dropped 3% since 2000, while the labor force grew 12%. The increase in available jobs were filled entirely by workers 55 and older, as this age group increased 91% over the same period, compared to a decrease in the 16-54 group. With the unemployment rate for workers 25-54 approaching lows of 3%, companies will be forced to reach all the way down to the youngest of eligible workers to fill the gaps. Unfortunately, these are the same workers who, until recently, have been held out of the labor force at record rates, gaining little to no work experience. The net result is that those who will be sucked in to fill the void left by the MOST EXPERIENCED WORKFORCE in history will have the LEAST EXPERIENCE in history.

Economist Theodore Schultz invented the term “human capital” in the 1960s to reflect the value of human capacities. He believed human capital was like any other type of capital; it could be invested in through education and training to increase workforce productivity. Today, the Association of Talent Development (ATD), the world’s largest association dedicated to those who develop talent in organizations, estimates that US companies invest over $150B in human capital annually. How will companies leverage the TRILLIONS OF DOLLARS in human capital investments poured into the exiting workforce? Companies prepared to transition their workforce will be able to swallow the mouse with ease and yield a net gain. For others, it will seem more like a snake trying to swallow a horse, rather than a mouse.

The good news is that it’s not yet too late to develop a strong transition plan, but with the recent changes in the economy, the time to act is now before all that knowledge, skills, and experience walk out the door, for good.

Per the TCRS report, the good news is only 26% of Baby Boomers plan to stop working immediately once they reach a certain age or attain a certain level of financial security. Instead, 39% plan to reduce hours or continue working in a different capacity. It would serve employers well to embrace this desire by finding new, meaningful ways for employees at or near retirement age to contribute to their organization. In fact, it will be a critical part of mitigating the LOSS OF HUMAN CAPITAL.

There is more good news, while the workforce expected to replace the retiring Baby Boomers will come with less experience than ever before, they also bring the strongest educational background. For the first time in American history, over one-third of the nation’s 25-29 year olds have completed at least a bachelor’s degree, according to an analysis by the Pew Research Center. In comparison, just 12 percent of people in that age group earned a bachelor’s degree 40 years ago. However, the mature soft skills and job related knowledge of the exiting Baby Boomer population will be severely missed.

Unlike Theodore Shultz’s theory that human capital is just like any other capital, knowledge, skills, and experience can be shared and passed down in varying capacities. At the very least, learning can be accelerated through proper knowledge-share practices. Many top companies have put systems and processes in place to ensure they can effectively operate somewhat independent of the people performing the job, but this doesn’t cover all aspects of what an experienced employee offers to an organization. There exists TACIT KNOWLEDGE within an organization that cannot be easily transferred through written means. The only way to transfer this type of knowledge is through human interaction, over time. The best of the best already have mechanisms in place to transfer this knowledge on a regular basis. Seventy percent of the Fortune 500 companies report having a structured mentoring program in place to transfer knowledge before it walks out the door for good. Also, many of the same companies offer would-be retirees alternative methods to sunset their careers in the form of reduced work schedules and transitioning some into full or part-time mentorship roles.

These Fortune 500 companies and many others have found that a structured mentorship program serves three primary functions related to the potentially disastrous prospect of knowledge, skills, and experience abruptly walking out the door:

1) It re-engages employees thinking about retirement by establishing a new sense of purpose. Both increasing productivity and preventing the loss of human capital investments.

2) It engages and accelerates the development of the younger workforce, thereby reducing the time to maximum productivity and overall turnover.

3) It sets a natural succession plan in place when workers finally decide to exit the workplace entirely.

We suggest a 3-step plan to make this happen:

1. Define the behavioral and cognitive requirements necessary to predict success in the job and screen candidates based on fits and gaps.

2. Interview based on an individual’s attitude, values, and commitment to excellence, rather than just knowledge, skills, and experience.

3. Engage your workforce, especially your seasoned workforce, in cascading knowledge through a structured mentoring program to develop a natural succession plan and preserve your human capital investments.

What will your minimal human capital investments in this 3-step plan yield? First, hiring practices based on behavioral, cognitive, and cultural fits for a job greatly increases the candidate’s likelihood of success. It’s undeniable that turnover due to retirement alone is expected to skyrocket in the very near future, therefore increasing your odds of bringing in the right talent will have a lasting positive impact on your organization and more importantly prevent the serious, negative consequences of continuing to invest in the wrong people. Second, the RIGHT TALENT can be accelerated through MENTORSHIP PROGRAMS, while the WRONG TALENT will walk out, be shown the door, or languish in a group of sub-par performers.

In many cases, you already have the knowledge, skills, and experience in your organization to succeed. Just don’t let your human capital investments evaporate as the economy rebounds.

Thank you for reading. If you found this information useful, please share it freely with your network.

For more information on putting together a successful mentor program read our articles, Don’t Waste Your Time with a Mentor Program and Don’t Bog Down the Mentors. As always, we are here to help.

About the Author:

Devin Lebrun, founder of Nuvivi, believes we are all born beautifully talented and exceptionally gifted. The path to massive success is simple. Recruit people into positions that leverage their innate abilities. Equip them with the necessary knowledge and skills. Match them with mentors who help them grow from past and present experiences. Watch their creativity and passion take your organization to new levels.

Nuvivi is partnered with FindAMentor and The Predictive Group to provide organizations with success tools. If you would like to get more out of your workforce, contact Devin at [email protected] or through LinkedIn for free consultation.

Daily Inspirational Email Sign Up

Daily Inspirational Email Sign Up